PH GDP Falls Below Forecasts, Needs Faster Growth Pace to Achieve Gov Targets

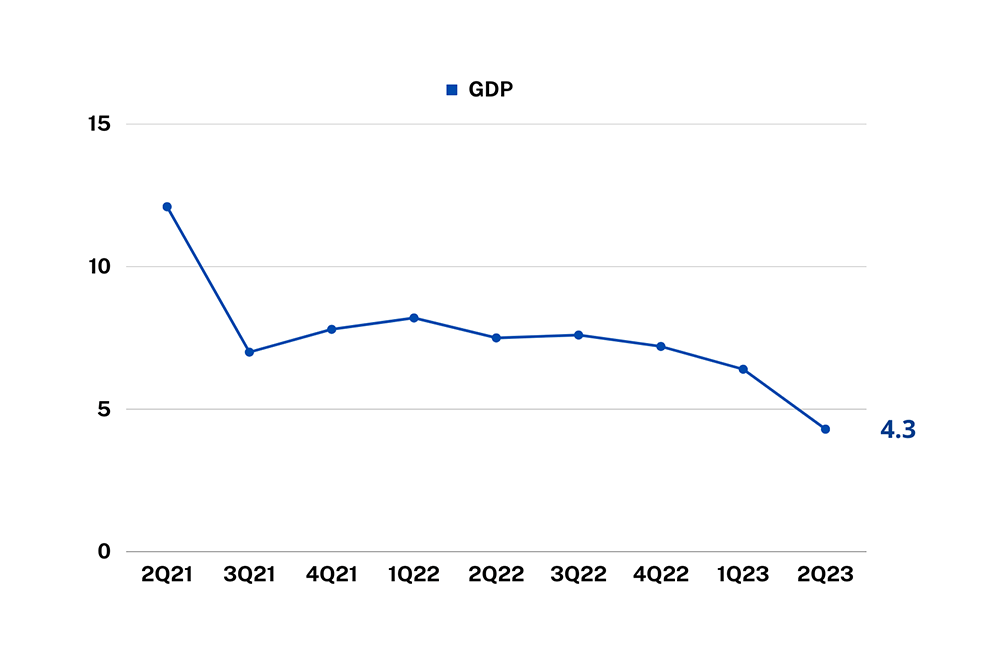

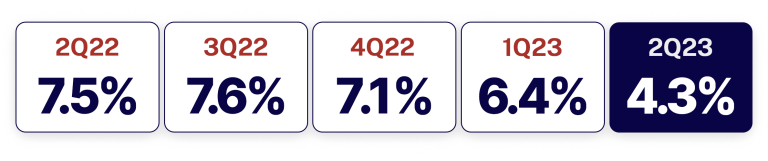

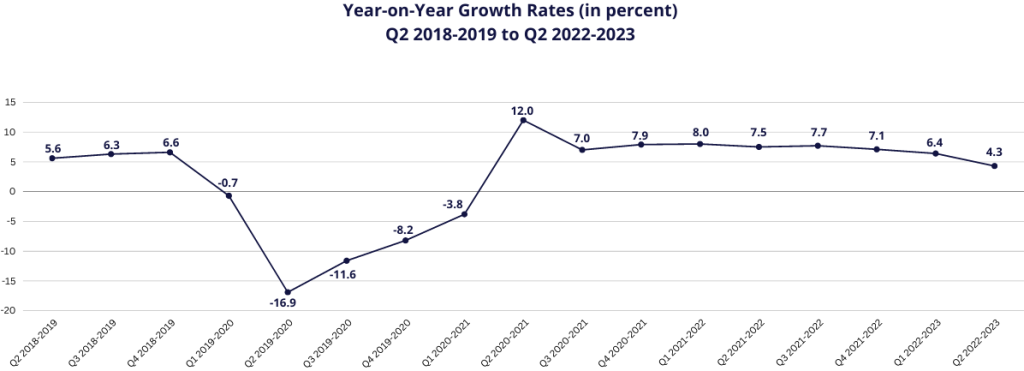

10 August 2023 — Philippine GDP growth slowed to 4.3% in the 2nd quarter of 2023 from 6.4% in the previous quarter and 7.5% from the same quarter last year. This is below the median estimate of local economists at 6% and the slowest since the first quarter of 2021. In a joint statement by economic managers, they noted that in order to achieve the government’s annual target of 6-7% GDP growth, the Philippine economy needs to grow by 6.6% in the second half of 2023.

According to NEDA Secretary Arsenio Balisacan, the slow down was “tempered by high commodity prices, laggard effects of interest rate hikes, the contraction in government spending, and slower economic growth.” He further attributed the slower growth to interest rate hikes done to temper inflation in the last few months: “The lag effects and uptick in interest rates last year and early this year, we are feeling it now.”

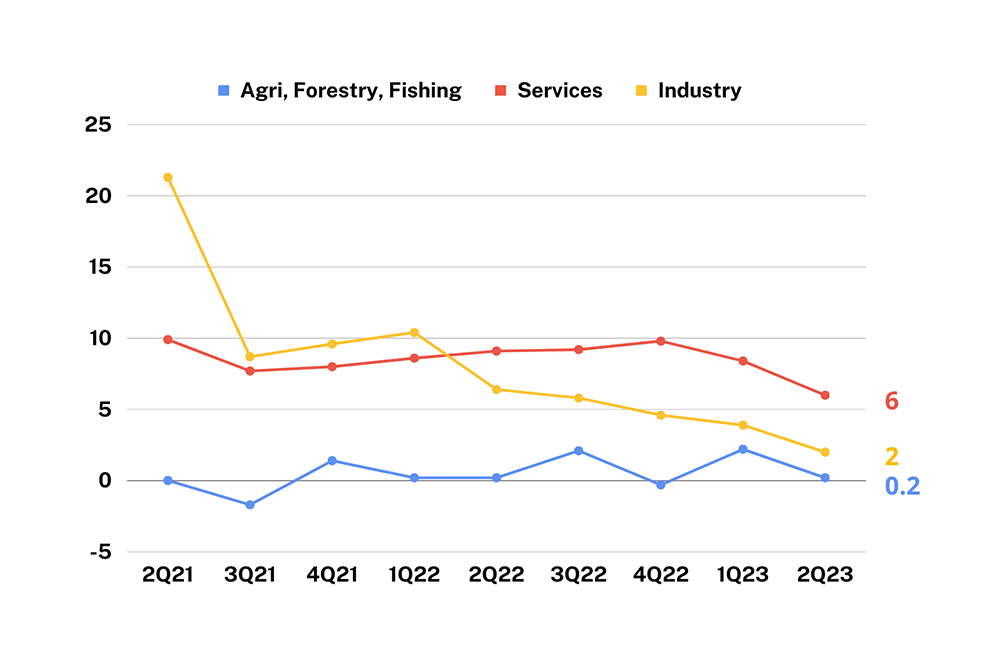

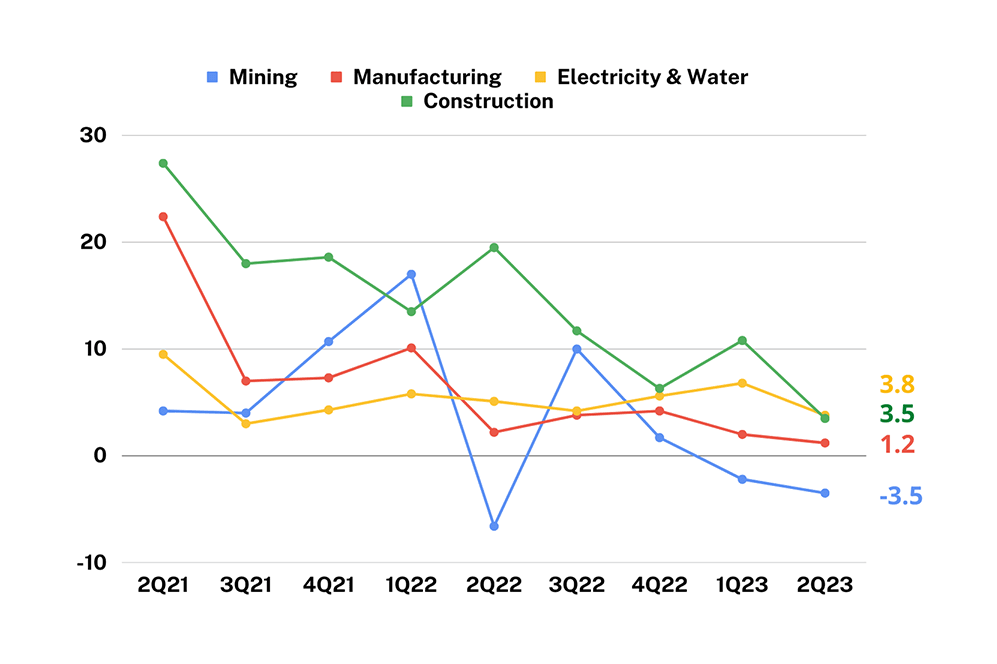

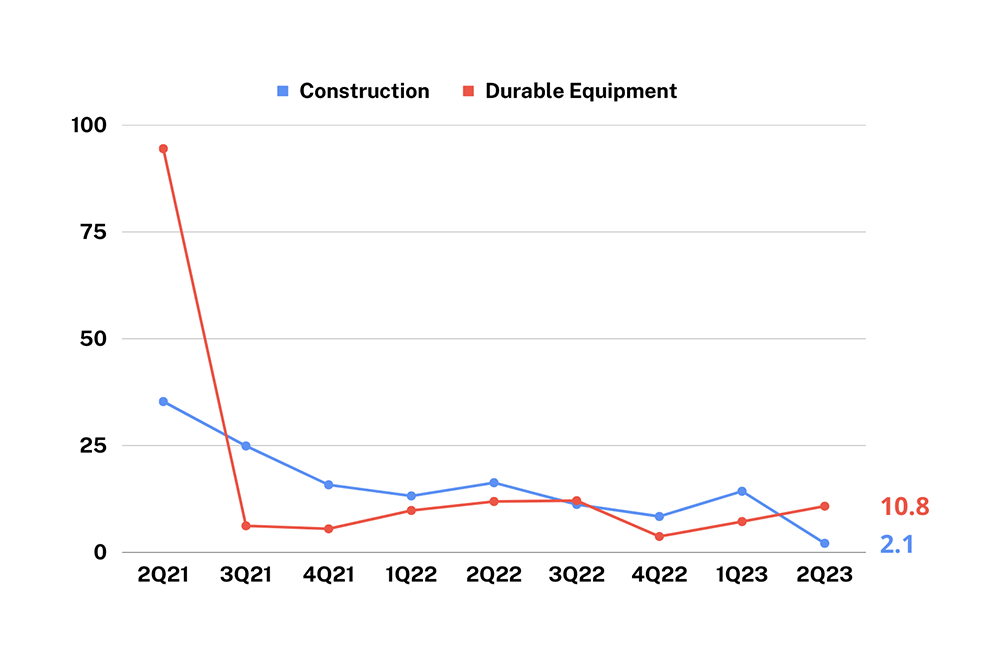

On the demand side, Government Spending contracted to -7.1% from 10.9% in the same quarter last year; Investment (gross capital formation) also contracted to -0.04% from a high of 17.2% in 2022, meanwhile Household Spending grew to 5.5%. On the supply side, Services grew 6.0%, Industry 2.1%, and Agriculture 0.2%. Trade grew with exports of goods and services at 4.1% and imports of goods and services inching up 0.4%.

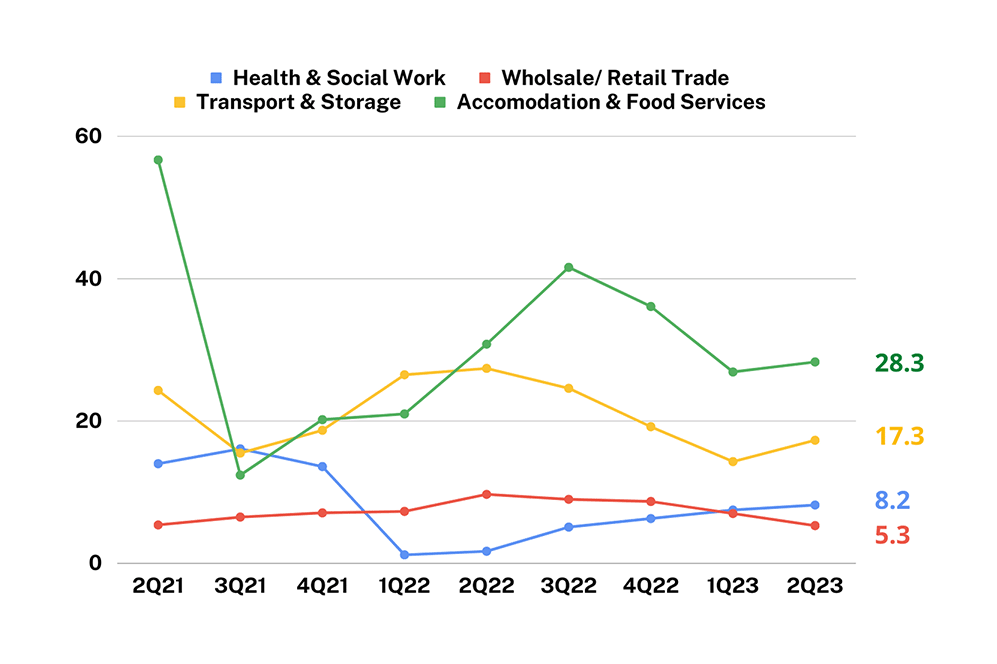

Some sub-sectors grew at a faster rate, Accommodation and Food Service activities grew at 28.3%, Other services (which includes arts, entertainment, and other service activities) at 22.2%, and Transportation and storage at 17.3%. Meanwhile, laggards during the second quarter were Mining and quarrying which further contracted at -3.5%, Public administration and defense (-2.4%), and Agriculture (0.2%).

The World Bank recently increased its 2023 growth forecast in June to 6% from 5.6% in April due to resilient domestic demand despite high inflation. This estimate, however, is at the lower end of the government’s 6-7% GDP target. This is also in contrast to a CNN poll of 11 economists who warned that due to inflation, the momentum of revenge spending could be waning which has a significant effect on the consumer-driven Philippine economy. This was echoed by the ADB Development Outlook from July 2023 which noted that “domestic consumption and investment continue to underpin growth in the region”. To reach government targets, Sec. Balisacan said that the government will continue its supply and demand side initiatives:

“We will continue to intensify our supply side interventions and demand side management measures to maintain overall price stability amid outside risks… Our target is to get inflation rates (down) to 2-4% especially for staples and basic commodities.”

Price increases for certain key commodities are predicted in the next few months. India, the world’s largest rice exporter, banned the exports of non-basmati white rice. Barclays recently pointed out that the Philippines would be the “most exposed to a rise in global rice prices”, which can have further effects on domestic consumption prospectively. Balisacan assured that “If there will be a shortage, we will be in a position to bring in additional imports if necessary.”

Growth in %

Insights from Key Economists

Co-presented by MBC's official Economy Partner

Share MBC's GDP Insights on Social Media

MBC Economy Dashboard

The Makati Business Club (MBC) pilots its Economy Dashboard and provides a snapshot of key socio-economic data to help executives and policymakers make better decisions in today’s fast-changing economy.

Makati Business Club's 2023 1Q GDP Insights

PH GDP Growth Slows in Q1 But Beats Expectations

11 May 2023 – Philippine GDP growth slowed to 6.4% in the 1st quarter of 2023. The PSA noted that this is the lowest recorded rate for the Philippines since the start of the recovery from the pandemic in the second quarter of 2021.

PH Economy Grew at 4.4% in 2025, Lowest Post-Pandemic Growth Recorded

PH Economy Grew 4.4% in 2025; Lowest Post-Pandemic Growth Recorded 29 January 2026 — Philippine Gross Domestic Product grew by 3.0% in the fourth quarter

Lessons from 2025: Clean Governance is Good Economics

Lessons from 2025: Clean Governance is Good Economics 26 January 2026 – 2025 started off with a major controversy surrounding the National Budget, which had

Statement on the 2026 General Appropriations Act

Statement on the 2026 General Appropriations Act 05 January 2026 – The 2026 General Appropriations Act, signed today by the President, represents an improvement compared