ATIN First Brown Bag Session on Withholding Tax for Online Merchants

01 March 2024 – The Makati Business Club and Grab Philippines co-organized the first brown bag session of the Alliance of Tech Innovators for the Nation (ATIN) at the Grab Philippines headquarters. The session discussed information on new regulations for the e-commerce sector.

Department heads from ATIN members – Grab, Lalamove, Lazada, and Shopee – mentioned their concerns on the new Bureau of Internal Revenue (BIR) regulations. Former DICT Undersecretary Monchito Ibrahim (ATIN Lead Convenor) moderated the discussion. Representatives from BIR and DTI enumerated the documents that e-marketplaces can use to monitor sales.

From BIR, the discussion was led by Micah Patiag of the Withholding Tax Implementation Section. She was joined by Section Chief Primo Marasigan and BIR Attorneys Anne Loraine Garcia and Edgar Allan C. Reyes. The BIR discussed its recently issued Revenue Regulation 16-2023, also known as the Creditable Withholding Tax for Online Merchants/Sellers for Goods and Services, and presented its implementation guidelines, requirements, as well as the implications to online merchants.

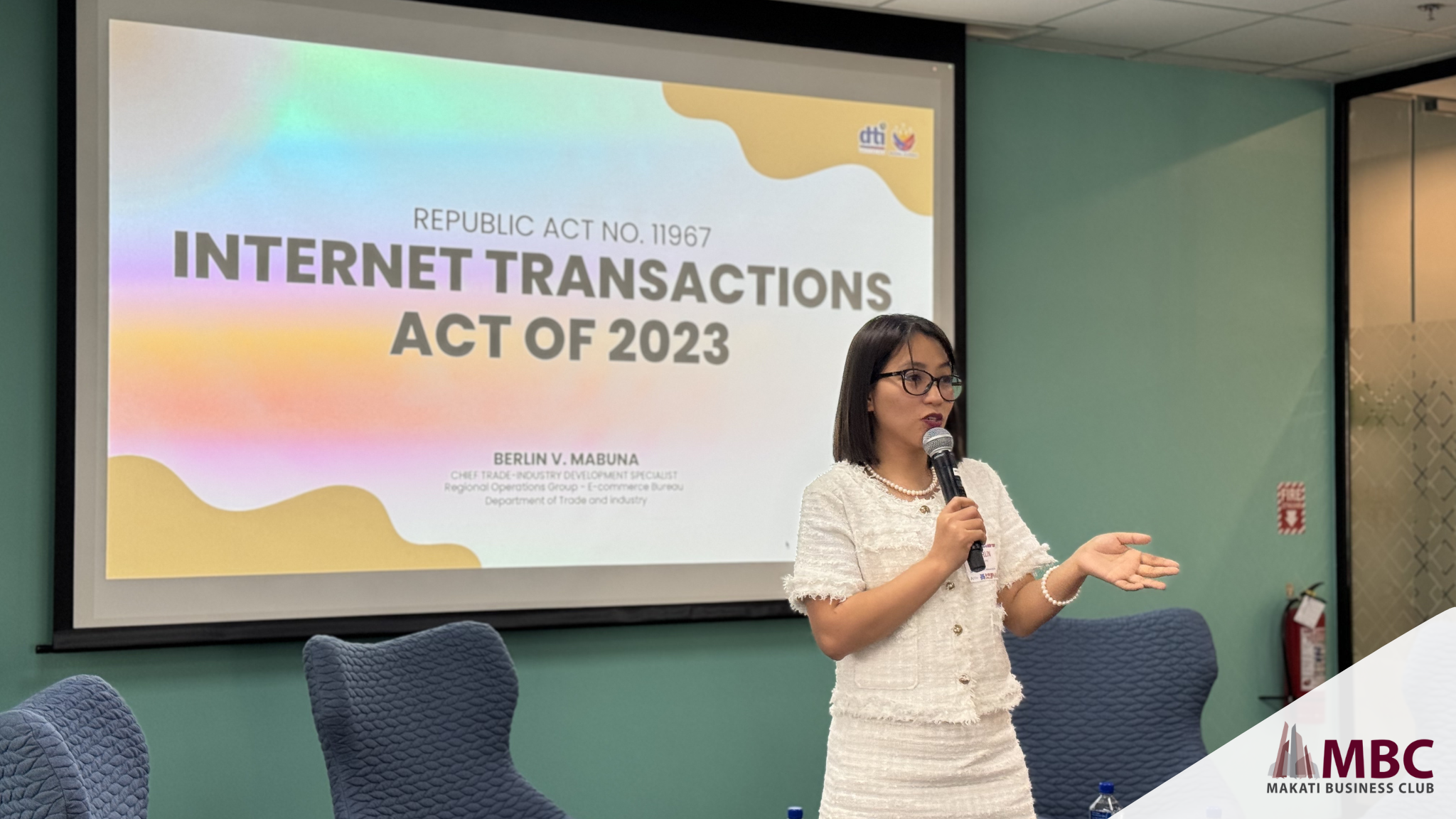

DTI Chief Trade Specialist Berlin Mabuna led the discussion on the recently passed Internet Transactions Act (ITA) and its specifics. She also noted there will be public consultations on the draft Implementing Rules and Regulations (IRR) of the ITA.

PH Economy Grew at 4.4% in 2025, Lowest Post-Pandemic Growth Recorded

PH Economy Grew 4.4% in 2025; Lowest Post-Pandemic Growth Recorded 29 January 2026 — Philippine Gross Domestic Product grew by 3.0% in the fourth quarter

Lessons from 2025: Clean Governance is Good Economics

Lessons from 2025: Clean Governance is Good Economics 26 January 2026 – 2025 started off with a major controversy surrounding the National Budget, which had

Statement on the 2026 General Appropriations Act

Statement on the 2026 General Appropriations Act 05 January 2026 – The 2026 General Appropriations Act, signed today by the President, represents an improvement compared