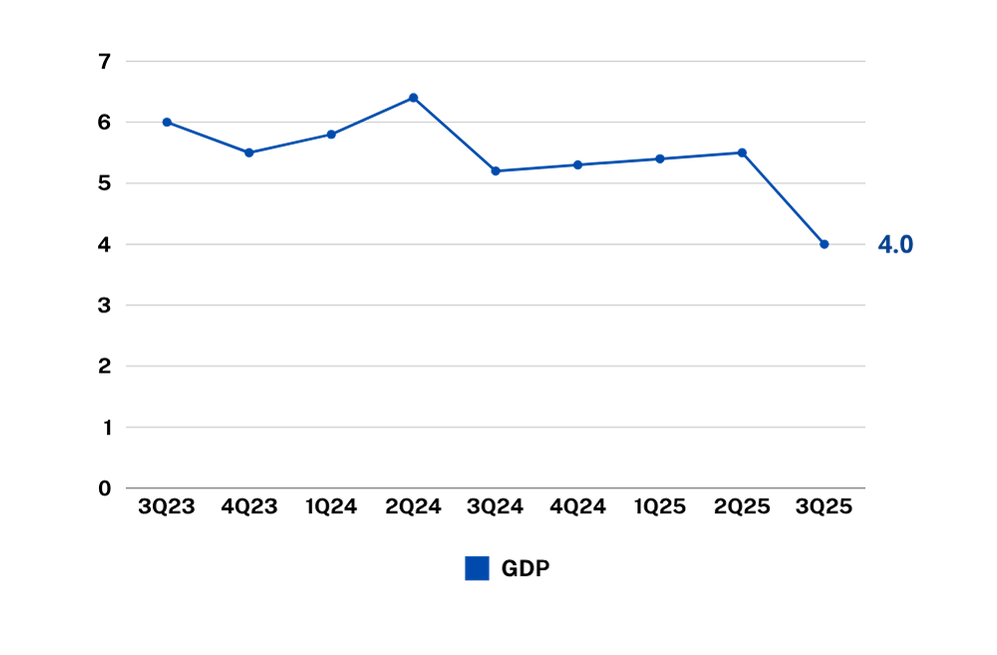

PH Economy Slows to 4% in Q3 2025 from 5.5% Last Quarter, Falling Below Government Target - Lowest Quarterly Growth since 2023

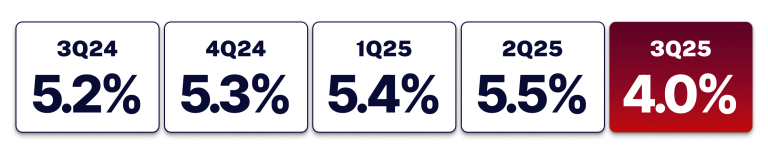

07 November 2025 — The Philippine economy grew by 4.0% in the third quarter of 2025, lower than the 5.5% recorded in Q2 and below the 5.2% growth posted in the same period last year. This falls below the government’s revised 5.5-6.5% full-year growth target and below the median forecast of economists at 5.3%. Moreover, this marks the slowest quarterly growth of the Philippine economy since 2023. DEPDev Secretary Asenio Balisacan emphasized that this is a reminder to “strengthen foundations for rapid, sustained, and inclusive growth.”

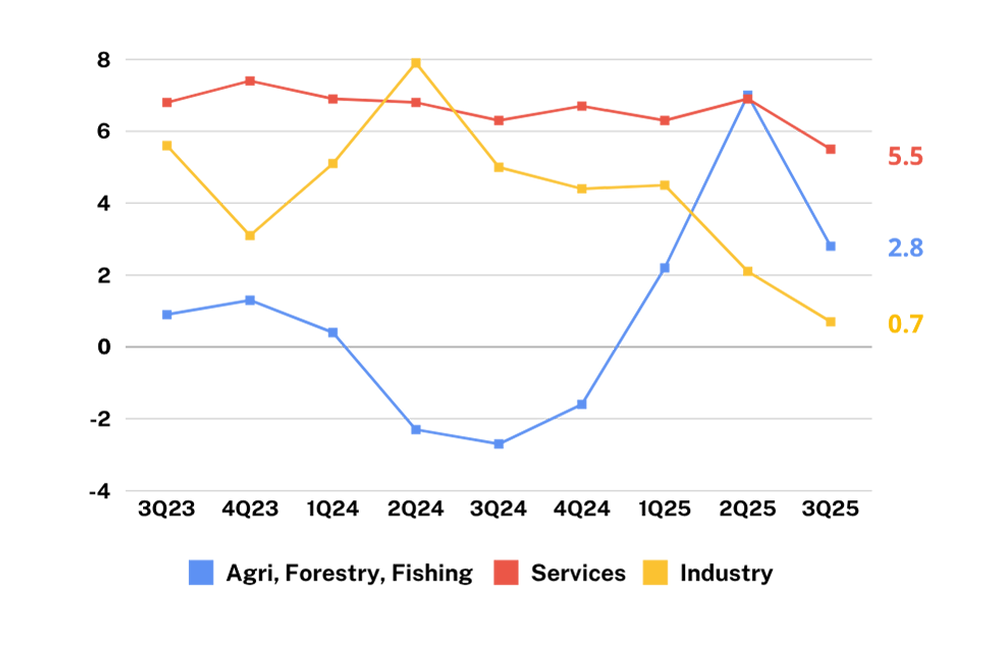

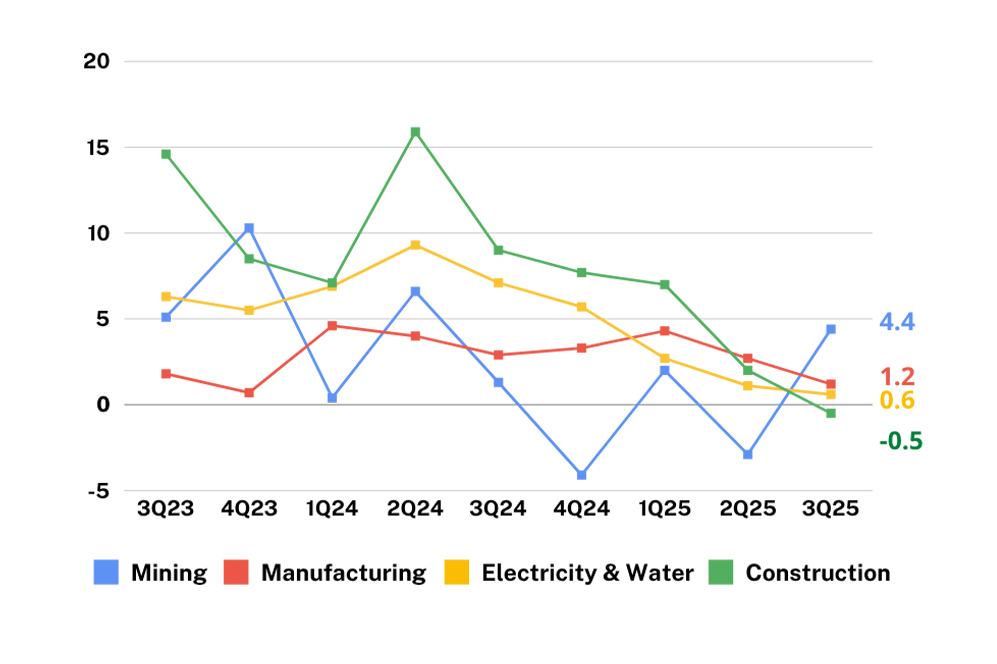

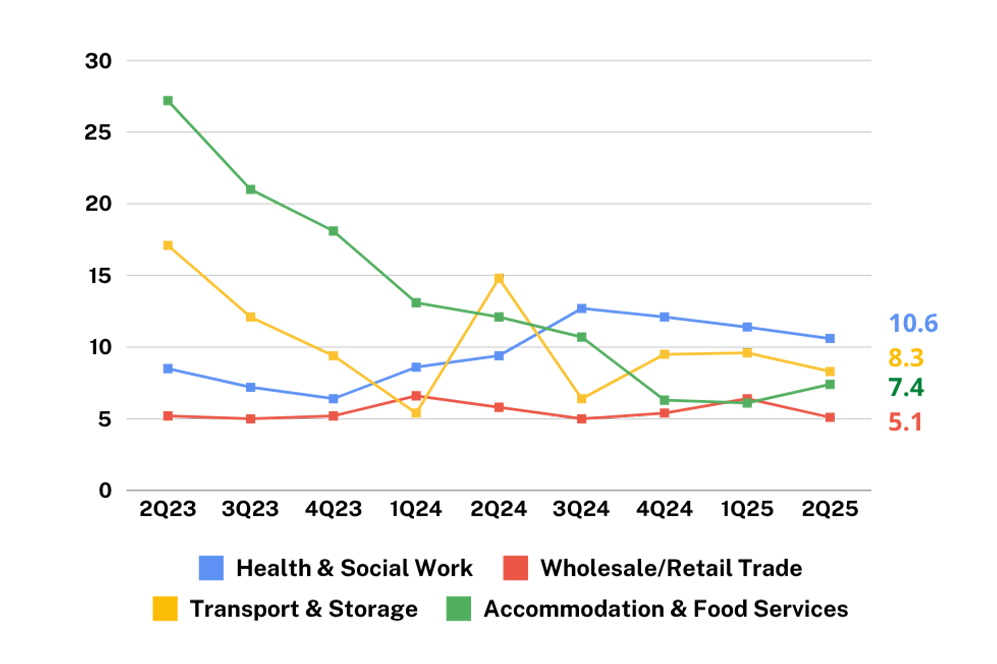

On the supply side, growth was mainly fueled by the Services sector, which expanded by 5.5% and contributed 3.6 percentage points to overall GDP growth. However, this is notably lower than the previous quarter’s growth at 6.9%. Top performing industries included Human Health and Social Work Activities (12.2%), Human Health and Social Work Activities (+12.2%), Education (+6.8%), Public Administration and Defense (+6.6%), and Professional and Business Services (+6.2%). There was a sharp decline in Industry growth, falling to 0.7%, its weakest performance since Q1 2020 at -4.2%. According to Sec. Balisacan, this slowdown was driven by decline in public construction, as the DPWH implemented stricter validation measures for civil works and enforced tighter billing and disbursement requirements due to corruption issues in flood control. This delayed project execution and spending. Meanwhile, Agriculture, Forestry, and Fishing grew by 2.8%, a sharp decline from 7.0% in the previous quarter, a likely result of typhoons.

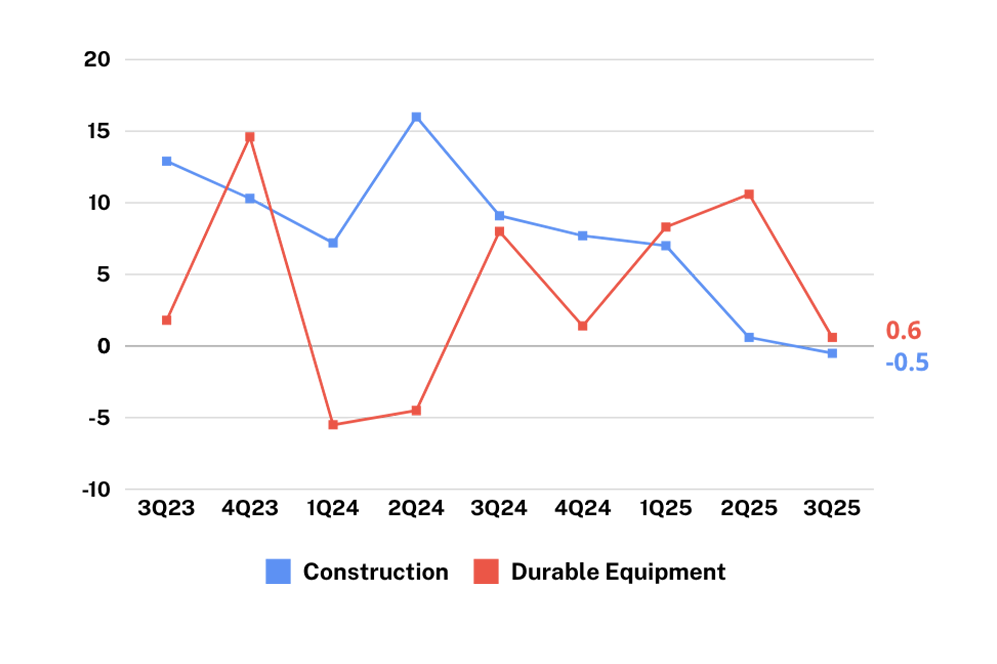

On the demand side, growth was led by Household Final Consumption Expenditure (HFCE), which rose 3.0%, reflecting slower spending across most categories. Secretary Balisacan noted that widespread cancellations of school, work, and travel activities during the quarter likely dampened consumer spending. Moreover, he also noted that consumer confidence was affected by public discussions around government infrastructure spending, prompting some households to delay durable goods purchases. The slower disbursement of Conditional Cash Transfers (CCTs) also contributed to these figures. Valuables (+40.4%), exports of goods (+11.6%), and imports of services (+6.4%) also posted notable increases. The government garnered a 5.8% growth, significantly lower from 8.7% in Q2, consistent with the tighter policies on public works and procurement. Usec. Mapa of the Philippine Statistics Authority also noted that public construction contracted by 26.2%, its sharpest drop since Q3 of 2011 at 22.5%.

The International Monetary Fund (IMF) had previously flagged rising trade tensions, political uncertainty, and climate shocks as factors that may affect Philippine economic growth in the near future. During the ASEAN Summit in Malaysia, Thai news report outlets revealed that the US granted zero percent tariffs on select products from Thailand, Cambodia, and Malaysia which could put the country at a potential disadvantage. However, according to Special Assistant to the President for Investment and Economic Affairs Frederick Go, the Philippines opted against zero tariffs to “protect several industries in the Philippines” such as rice, corn, sugar, and poultry. The Philippines initially got a lower tariff at 17% but after rounds of negotiations with other ASEAN countries, the current tariff rates from the US range around 19-20% for the Philippines, Malaysia, Cambodia, Thailand, Vietnam, and Indonesia. However, Secretary Balisacan noted that exemptions on electronics and pursuing trade agreements outside of the US is being pursued by the government: “On the external front, electronics exports may continue to benefit from stable demand as well as the exemption from U.S. tariff increases. We are aggressively pursuing free trade agreements with the UAE, Chile, EU, and Canada; and fully implementing the Regional Comprehensive Economic Partnership.”

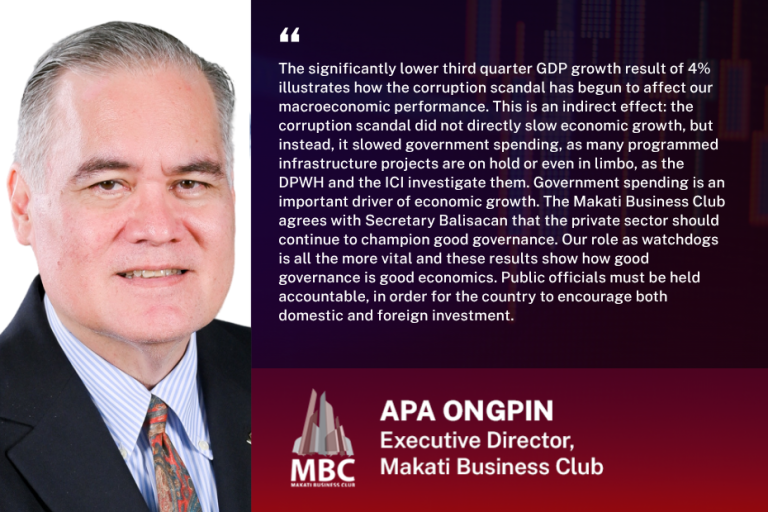

As for political uncertainty, the latest analysis from Fitch ratings noted that the ongoing corruption investigations pertaining to “ghost” or nonexistent flood control projects can affect the economy, according to Fitch Ratings: “domestic political uncertainty could affect investment, with allies of President Ferdinand Marcos doing worse than we expected in the recent midterm elections and a recent corruption scandal.” GlobalSource Partners’ analyst Diwa C. Guinigundo and Wilhelmina C. Mañalac echoed these sentiments noting that the scandals can prevent the Philippines from reaching its 6% growth target: “These funds — siphoned through fraudulent contracts and padded budgets — could have built schools, improved hospitals, and created up to 266,000 jobs. The resulting drag on productivity meant economic growth of 5.5-5.7%, when the economy could have expanded closer to over 6%”. To address these, Sec. Balisacan has noted that priority reforms in the common legislative agenda includes amendments to the Bank Deposits Secrecy Law to support anti-corruption investigations, amendments to the Anti-Money Laundering Act to strengthen enforcement, and the proposed Master Plan for Infrastructure and National Development. He also mentioned the possibility of applying a rule to “disqualify relatives of public officials up to the fourth degree from participating in government contracts.”

The Makati Business Club has been actively involved in initiatives promoting transparency and accountability to ensure integrity in the 2026 national budget.

Growth in %

Insights from Key Economists

Share MBC's GDP Insights on Social Media

MBC Economy Dashboard

The Makati Business Club (MBC) pilots its Economy Dashboard and provides a snapshot of key socio-economic data to help executives and policymakers make better decisions in today’s fast-changing economy.

PH Economy Grew at 4.4% in 2025, Lowest Post-Pandemic Growth Recorded

PH Economy Grew 4.4% in 2025; Lowest Post-Pandemic Growth Recorded 29 January 2026 — Philippine Gross Domestic Product grew by 3.0% in the fourth quarter

Joint Statement on Political Dynasties and House Bill No. 6771

Joint Statement on Political Dynasties and House Bill No. 6771 13 February 2026 – The absence of an effective Anti-Dynasty Law has allowed political power

Lessons from 2025: Clean Governance is Good Economics

Lessons from 2025: Clean Governance is Good Economics 26 January 2026 – 2025 started off with a major controversy surrounding the National Budget, which had

Statement on the 2026 General Appropriations Act

Statement on the 2026 General Appropriations Act 05 January 2026 – The 2026 General Appropriations Act, signed today by the President, represents an improvement compared