PH Economy Grew 4.4% in 2025; Lowest Post-Pandemic Growth Recorded

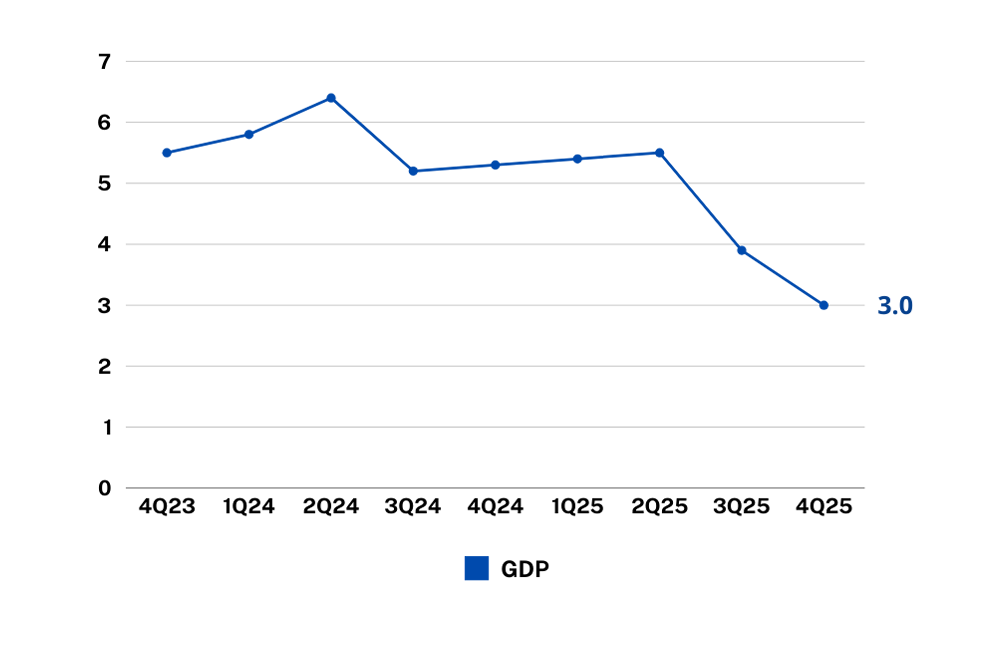

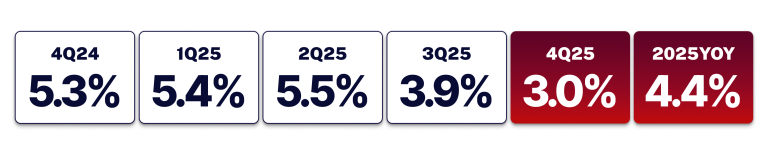

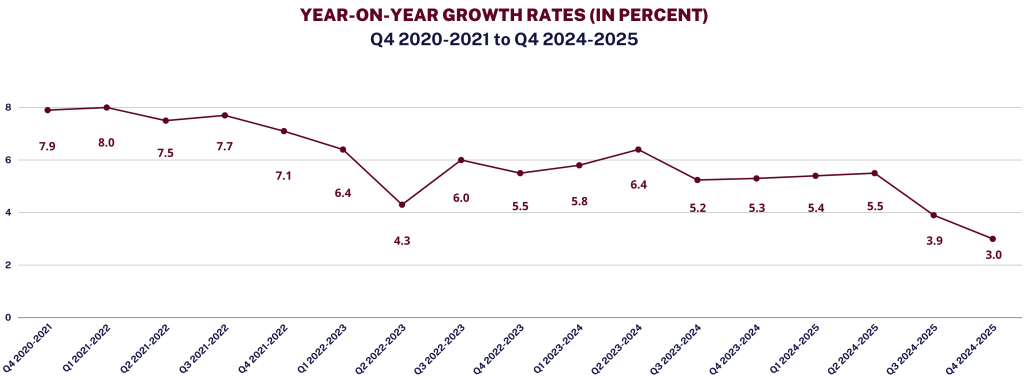

29 January 2026 — Philippine Gross Domestic Product grew by 3.0% in the fourth quarter of 2025, 43% lower than the 5.3% growth recorded in the same quarter last year, according to the Philippine Statistics Authority (PSA).

This wrapped up 2025 full year growth at 4.4% from 5.7% in 2024, below the government’s growth target of 5.5 to 6.5 percent for 2025. Both numbers are also below the median forecast of economists at 4.2% for Q4 2025 and 4.8% for full year growth.

This performance marks the slowest full-year post- pandemic expansion for the Philippine economy. Outside of the pandemic, Q4 2025 is the slowest growth since Q3 2011 (both at 3%), when the Aquino administration suspended several infrastructure projects over corruption concerns linked to the previous government, leading to a 31.8% decline in government construction spending.

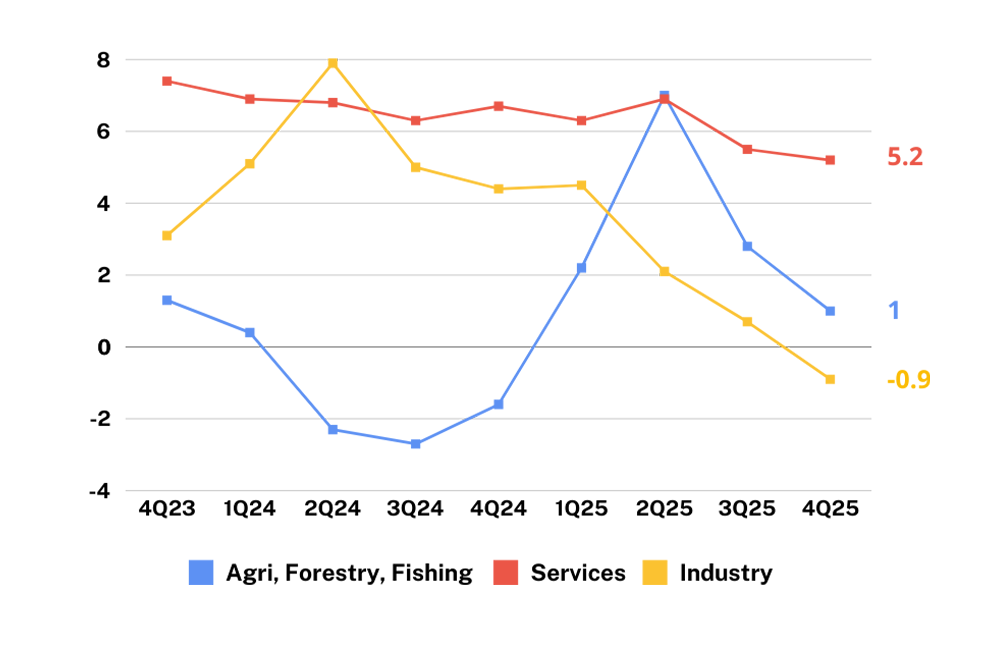

On the supply side, the Services sector continues to drive overall growth as it expanded by 5.2% in Q4, and contributed 3.2 percentage points to overall GDP growth. DEPDev Secretary Balisacan noted that despite weather and climate-related disruptions, agriculture, forestry, and fishing posted positive growth of 1.0%, contributing 0.1 percentage point. Industry contracted by 0.9%. For 2025, Services grew by 5.9%. accounting for 3.7 percentage points of total GDP growth. Agriculture, forestry, and fishing expanded by 3.1% for the year, a notable increase from the -1.6% recorded in 2024, contributing 0.2 percentage point to overall growth. Industry expanded marginally, contributing 0.4 percentage point.

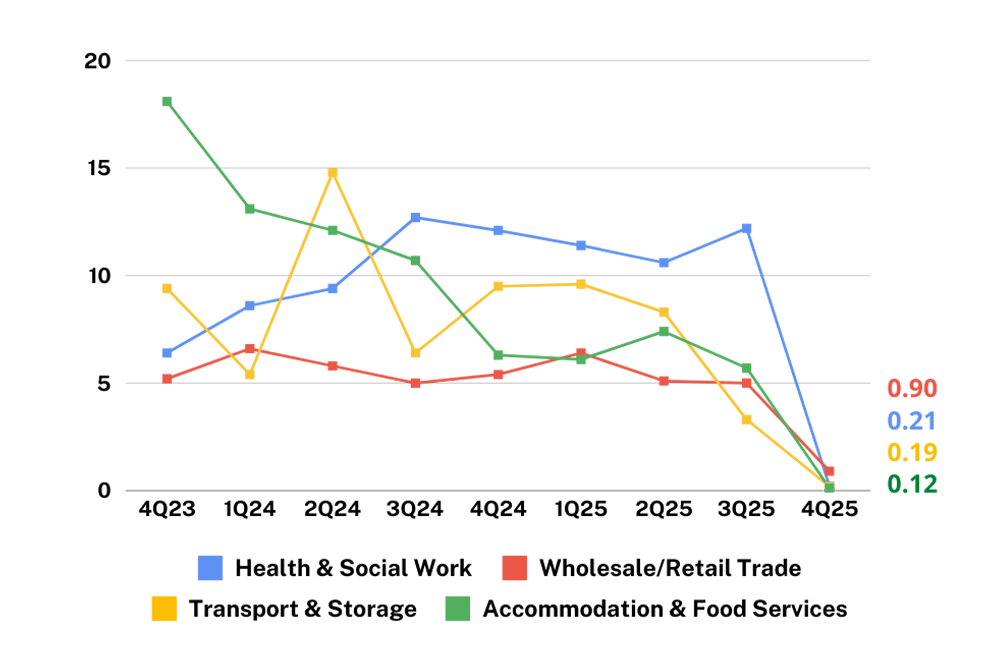

Among industries, the fastest-growing sectors in Q4 were Human Health and Social Work Activities (+11.5%), Education (+8.4%), Public Administration and Defense; Compulsory Social Security (+8.0%), and Transportation and Storage (+6.8%). The largest contributors to GDP growth during the quarter were Wholesale and Retail Trade (0.9 percentage point), Financial and Insurance Activities (0.5 percentage point), and Public Administration and Defense (0.4 percentage point).

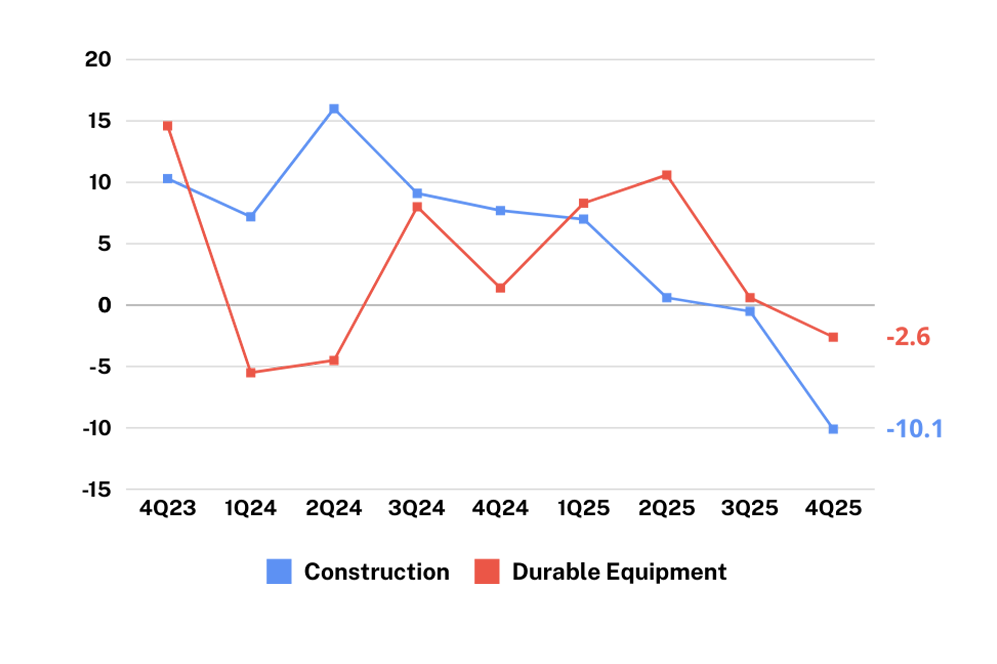

On the demand side, exports of goods was the fastest-growing demand component with 22.8% growth in Q4 2025. This was followed by Imports of services (+4.2%), Household Final Consumption Expenditure (HFCE) (+3.8%), and Government Final Consumption Expenditure (GFCE) (+3.7%). Government consumption fell significantly from 18.7% in the start of the year (Q1 2025) and 9.0% in Q4 2024 to 3.7% in Q4 2025, reflecting tighter public spending due to corruption issues and stricter measures on infrastructure projects toward the end of the year.

For full year statistics in 2025, exports of goods grew by 14.1%, while Government consumption expanded by 9.1% higher than the 7.2 GCE recorded in 2024. HFCE remained the largest contributor to annual growth, contributing 3.3 percentage points, followed by Government consumption (1.3 percentage points) and durable equipment investment (0.28 percentage point).

DEPDev Secretary Balisacan emphasized the role of “quality” public spending in supporting economic activity, and also acknowledged that the flood control corruption scandal undemined business and consumer confidence: “This outcome reflects several converging factors … adverse economic effects of climate-related disruptions, which led to several unexpected work suspensions; as well as the measures we are taking to ensure that only the right infrastructure projects move forward. Admittedly, the flood control corruption scandal also weighed on business and consumer confidence. These challenges unfolded alongside lingering global economic uncertainties.”

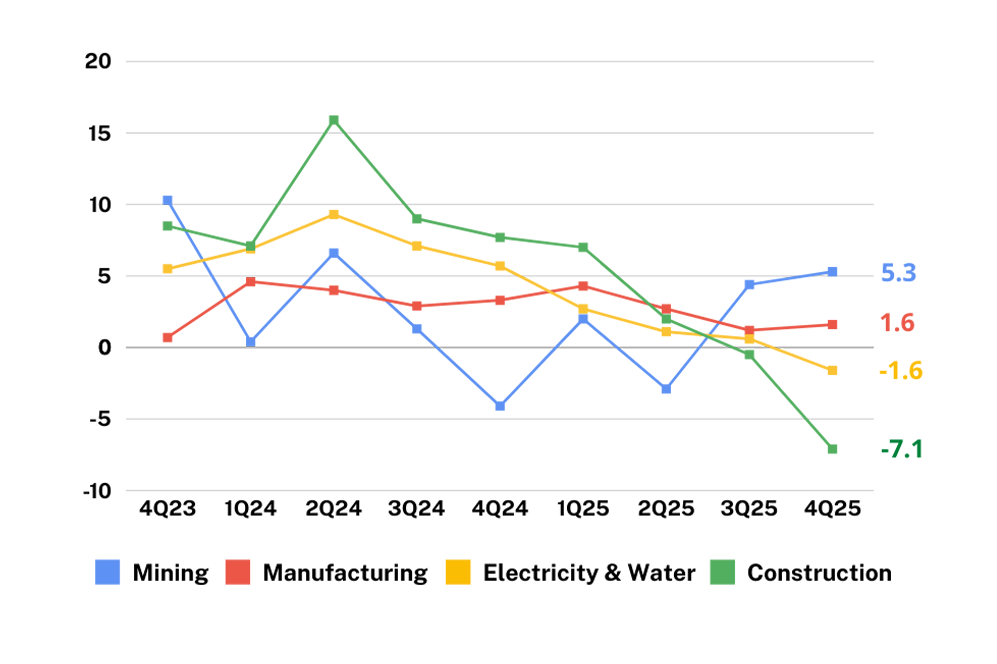

The year 2025 began with steady movement. Economic growth edged up to 5.4% in Q1 (from 5.3% in the previous quarter). This growth was supported by election-related spending earlier in the year and an 18.7% increase in government expenditure. Q2 growth held steadily at 5.5%. However, in Q3 growth fell sharply to 4%, well below target and forecasts. The slowdown followed a corruption scandal that exploded during the President’s State of the Nation Address on July 28, which led to a suspension of infrastructure projects, amid investigations by Congress, the Department of Justice, the Ombudsman, and the newly created Independent Commission for Infrastructure (ICI). As a result, public construction spending fell by 26.2% in Q3. By September 2025, the Bangko Sentral ng Pilipinas reported that FDI inflows fell to their lowest monthly level in over five years, indicating that political uncertainty had affected investor confidence and its effects had gone beyond sharp falls in public spending.

The Organisation for Economic Co-operation and Development (OECD), in its economic outlook forecasts that the Philippines is likely to miss the government’s previous growth targets, until 2027. The OECD lowered its GDP growth forecast for 2026 to 5.1% from an earlier 6%, and projected a growth of 5.8% in 2027. These estimates fall short of the government’s 5.5–6.5% growth target of 6–7% target for 2026–2028. According to the OECD, these projections can be attributed to prospectively lower public spending due to ongoing corruption investigations: “A more persistent-than-expected weakness in public investment related to tighter corruption controls and weaker investor confidence could weigh on domestic demand over 2026”.

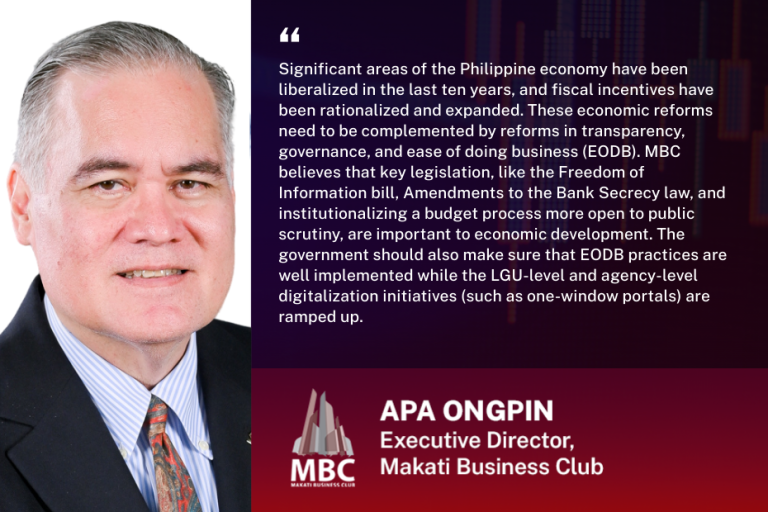

Meanwhile the International Monetary Fund (IMF) cautioned that the Philippine economy remains vulnerable to external shocks, such as higher global tariffs, supply chain disruptions, tighter financial conditions abroad, and weaker demand for Philippine exports. It urged the government to strengthen its “buffers” which are stronger policy reforms and reserves. The IMF emphasized the need for structural reforms to boost long-term resilience and growth. These areas they cited include: improving the ease of doing business, strengthening transparency and anti-corruption measures, enhancing public financial management, investments in education and workforce skills, accelerating digitalization, and reinforcing social safety nets to help households and firms adapt to challenges such as natural disasters and artificial intelligence.

Growth in %

Insights from Key Economists

Share MBC's GDP Insights on Social Media

MBC Economy Dashboard

The Makati Business Club (MBC) pilots its Economy Dashboard and provides a snapshot of key socio-economic data to help executives and policymakers make better decisions in today’s fast-changing economy.

PH Economy Slows to 4% in Q3 2025 from 5.5% Last Quarter, Falling Below Government Target – Lowest Quarterly Growth since 2023

PH Economy Slows to 4% in Q3 2025 from 5.5% Last Quarter, Falling Below Government Target – Lowest Quarterly Growth since 2023 07 November 2025

Lessons from 2025: Clean Governance is Good Economics

Lessons from 2025: Clean Governance is Good Economics 26 January 2026 – 2025 started off with a major controversy surrounding the National Budget, which had

Statement on the 2026 General Appropriations Act

Statement on the 2026 General Appropriations Act 05 January 2026 – The 2026 General Appropriations Act, signed today by the President, represents an improvement compared

Joint Statement: Business Groups Urge the Creation of a Fully-Empowered Anti-Corruption Body

Joint Statement Business Groups Urge the Creation of a Fully-Empowered Anti-Corruption Body 10 December 2025 – We, the undersigned Philippine Business Groups, respectfully convey our